Bookkeeping

A Comprehensive Guide on Returned Merchandise Journal Entries

You might offer free returns, charge a restocking fee, accept returns only with a receipt, or not accept returns at all. Or, maybe you decide to compensate customers returning items with store credit. These two journal entries complete the accounting process required in the books of the seller for the return of merchandise.

Journal Entry for Purchase Returns or Return Outwards

They are goods that were once purchased from external parties, however, because of being unsatisfactory they were returned back to them, they are also called Purchase returns. On 1 February 2016, John Enterprise annuity present value formula calculator sold merchandise for $1,500 to Sam Enterprise on account. On the same date, merchandise amounting to $200 were returned to John Enterprise because they failed to meet the required quality standards.

Table of Contents

You can set-up a sales returns and allowances account by opening an appropriate account in your chart of accounts. You can then create journal entries from the beginning that will automatically debit this new account on all future transactions. Sales revenue is the income statement account, and it is recognized when the control is passed to customers. Sales revenue is increasing in credit and decreasing in debit accounts.

Purchase Return Journal Entry

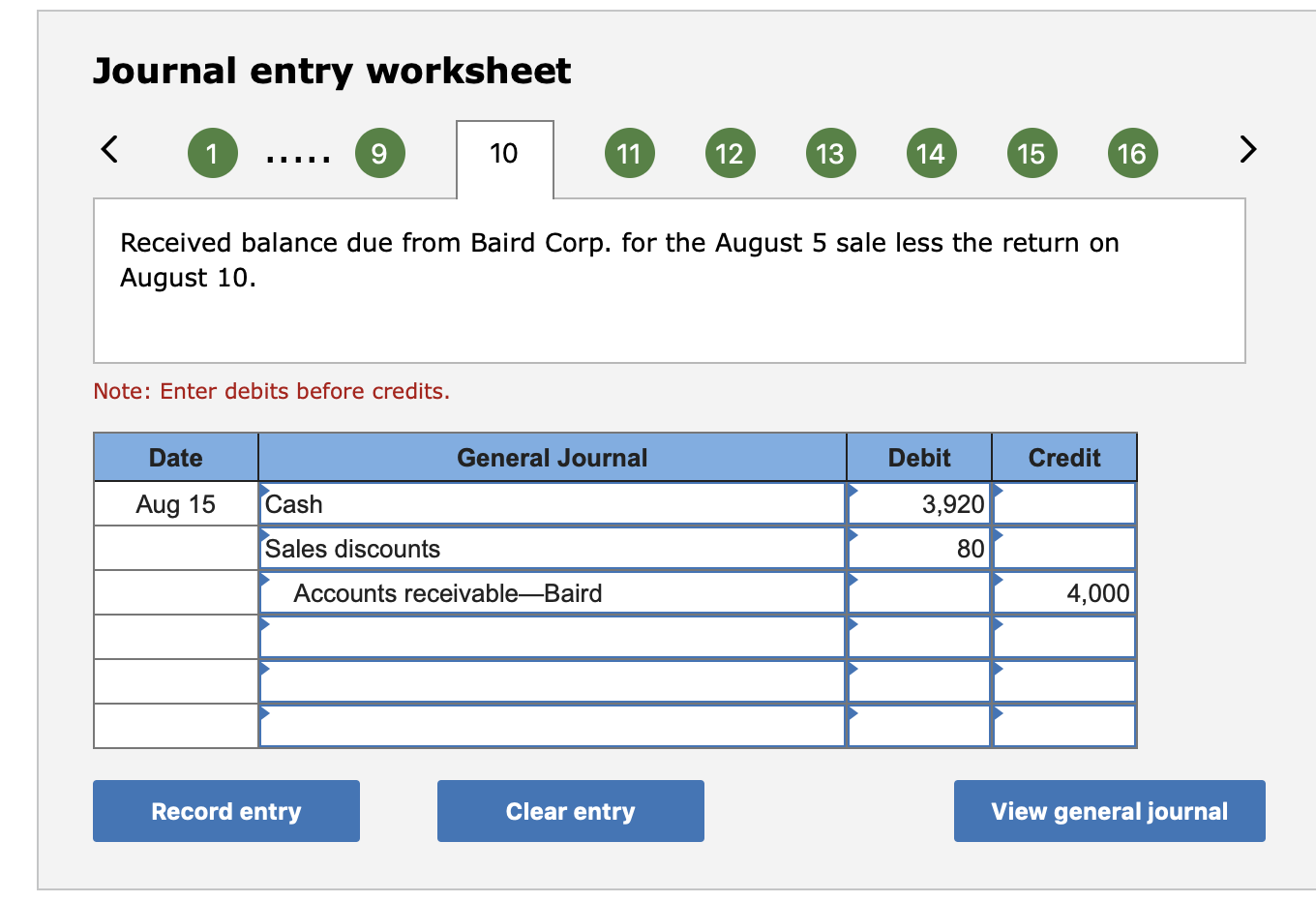

Depending on a transaction’s terms and conditions, goods purchased both in cash and credit may be returned. To update your inventory, debit your Inventory account to reflect the increase in assets. And, credit your Cost of Goods Sold account to reflect the decrease in your cost of goods sold. If the customer’s original purchase was made using credit, you recorded the original sale by increasing your Accounts Receivable account through a debit.

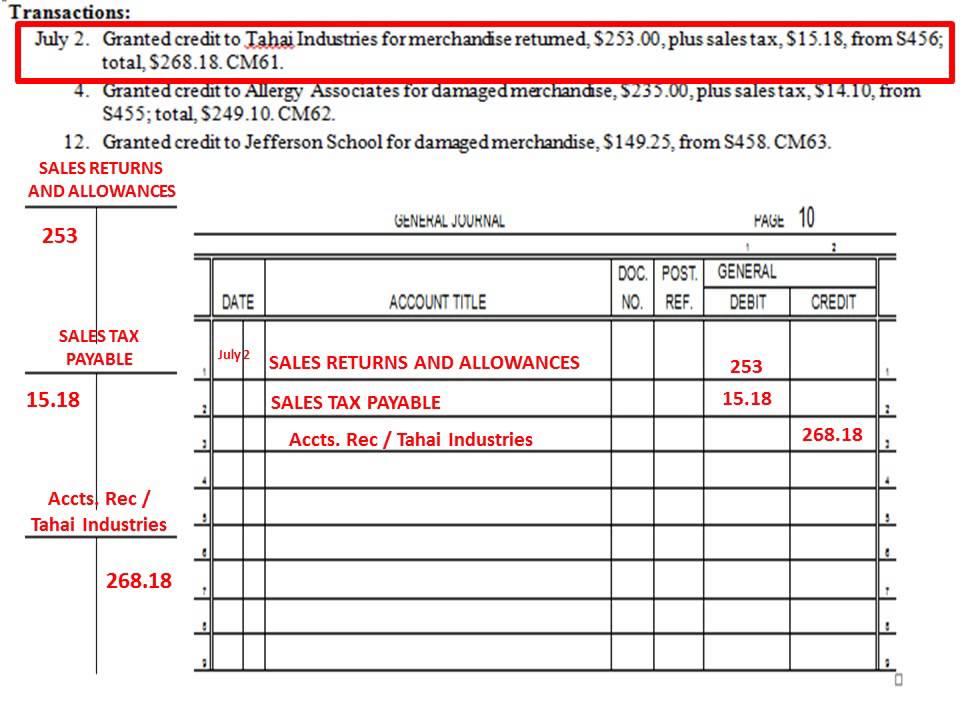

In this entry, the sales returns and allowances account is debited and the accounts receivable account is credited. The seller makes an adjusting entry in which the accounts payable account is debited and the sales returns and allowances account is credited. This journal entry ensures that payment has been received for the returned goods. When customers return merchandise sold for cash, the sales returns and allowances account is debited and the accounts payable account is credited.

- This example shows how to record the following transactions in John’s returns outward book.

- Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

- The goods will deliver to the customer, and the inventories will reduce.

- Once the item has been received, it must be inspected to determine the cause of the return.

- If the sales were cash sales, we should credit them to the cash or bank account since the company will need to pay back to the customer.

- So, when a customer returns something to you, you need to reverse these accounts through debits and credits.

Ask a question about your financial situation providing as much detail as possible. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Finance Strategists has an advertising relationship with some of the companies included on this website.

The transaction in both cases is reversed and the related sale or purchase is nullified. Despite the advantages mentioned above, there are a few factors that prove to be a hassle. Let us understand the disadvantages of credit or cash purchase return journal entries through the discussion below. Passing these journal entries helps companies determine the exact stock in their inventory by reducing the returns from their suppliers.

Accounting for a purchase return with store credit is similar to a cash refund. But instead of entering in your Cash account, you credit your Accounts Payable account. How you handle purchase returns depends on your small business return policy.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

The journal entry is debiting inventory $ 20,000 and credit cost of goods sold $ 20,000. First, we need to reverse the accounts receivable and record sale return. Another journal entry is debiting inventory and credit cost of goods sold. The company has to reverse the transaction which records during the sale process. This example shows how to record the following transactions in John’s returns outward book.

Because if you sell products at your business, you know that not all customers are satisfied. If a customer wants to bring back an item, you need to make sales returns and allowances journal entries. Some companies may not have sales returns and allowances account for some reasons, e.g. they do not have many transactions, so it is not worth keeping track. In this case, the company usually directly debit sales revenue and credit accounts receivable to reverse the original sale transactions when there are sales returns.